In this episode of LAB Radio, Aaron Mangal discusses the Coinigy platform with Derek Urben, CFO of Coinigy, headquartered in Milwaukee, Wisconsin.

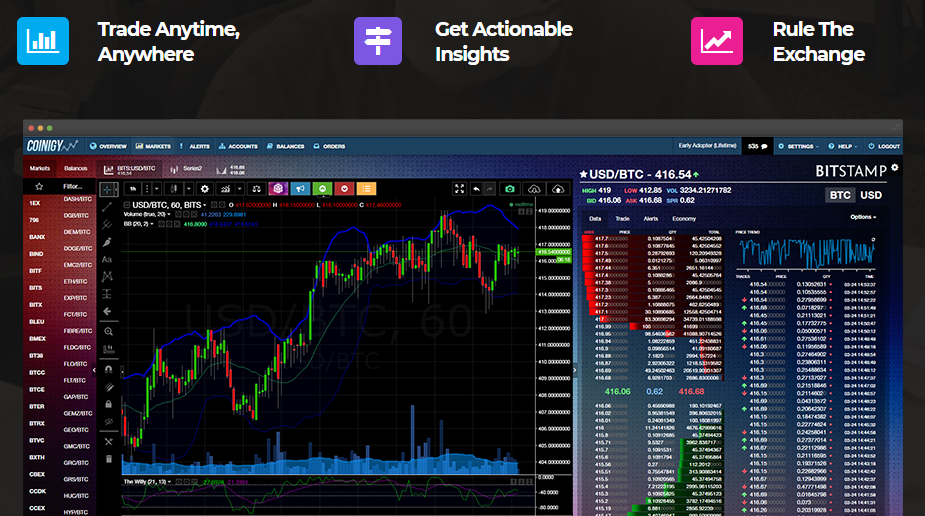

This service provides a cross-exchange charting, portfolio management, trading, and research platform stretches across over 45 exchanges with 75+ technical indicators all under a single pane of glass interface.

On the alerts side of things, you can trigger SMS, E-Mail and in-browser price alerts to your customized parameters powered by low-latency data feeds. (E.g. Bitcoin alert when it goes up or down at least 20%)

Derek Urben, CFO at Coinigy

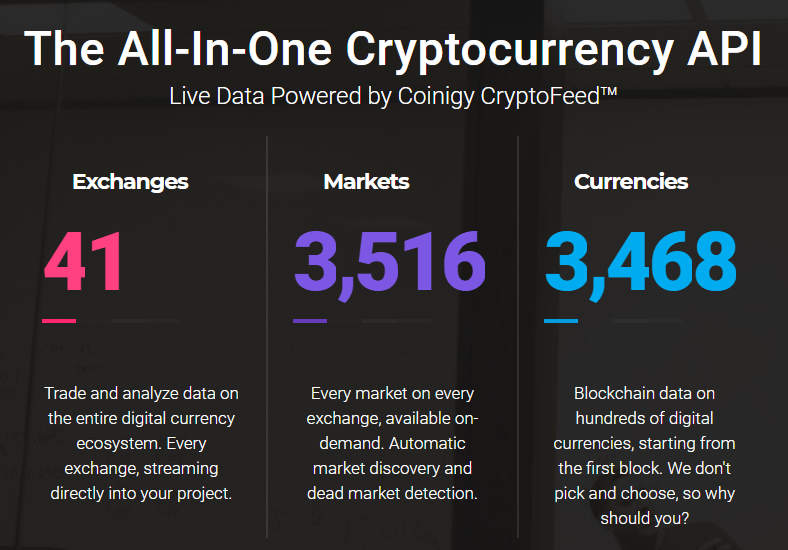

In addition, they allow instant access to real-time APIs and historical data and there’s the ability to leverage enterprise-grade data feeds for individuals and institutions.

Using a monthly subscription model, the platform allows users a wide cornucopia of data sets and access to exchanges including the possibility to execute trades through a secure Application Programming Interface (API).

The API is live, real-time data powered by the Coinigy CryptoFeed™. This API stretches across 41 exchanges, 3,516 markets and 3.468 cryptocurrencies.

After listening to this episode you will learn:

- About Derek’s origin story and how he got started in the Cryptocurrency space

- Who the users of the platform are

- Why they don’t hold user funds

- The emergence of just about anything “as a service”

- Why the membership subscription model was chosen

- Basic security practices and architecture behind the platform and how it protects users

- Why APIs are a common practice along with cloud computing for traditional trading houses

- About their research arm and the types of information they aggregate

- How they position as an aggregator allows a non-biased exploration of the ecosystem

- Why the future of firms, mergers and private equities will shift dramatically

Further Reading and Resources

- Derek on LinkedIn

- Coinigy website | Facebook | LinkedIn | Twitter

- API Documentation

- Coinigy Insights

Derek discusses the platform: