On this episode of LAB Radio we talked global remittances, markets, market making and how to use Cryptocurrencies and the Blockchain to help the cash-in and cash-out businesses. We brought on George Harrap, CEO and co-founder of Bitspark, a bank-less money transfer ecosystem. Bitspark enables businesses and people to cash in and cash out of cryptocurrencies and fiat across developing nations (and is enabling liquidity for 150+ foreign currencies)

George Harrap, CEO and co-founder of Bitspark

“A Cryptocurrency and Blockchain pioneer, one of the early users of Bitcoin since 2011, I co-founded Bitspark (Hong Kong) in 2014 with the mission of bringing low cost fast cryptocurrency based settlement to cross border transactions. Often an international speaker around the world, I am focused on empowering individuals and businesses with blockchain based payments to further financial inclusion and bring greater cost efficiencies leading to better world without the need for the legacy banking system.”

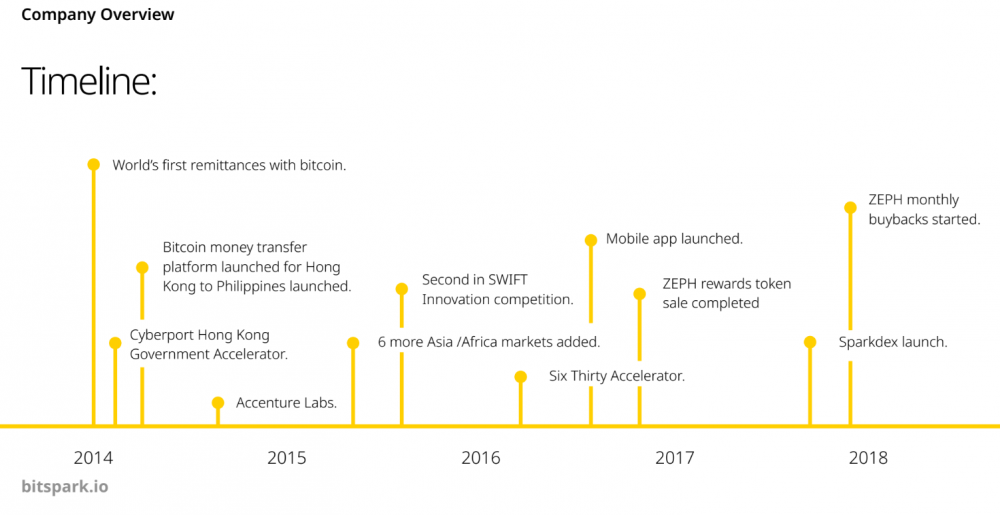

Here’s a timeline of their company and activity to date:

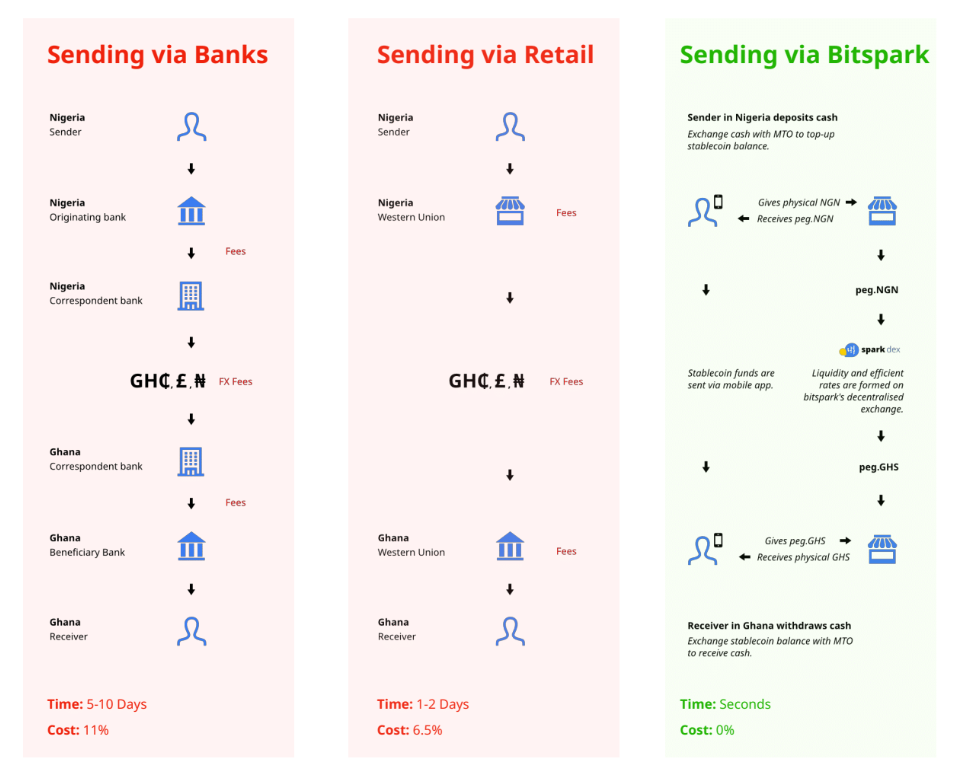

Their business began as a cash in cash out remittance service and still has roots in it:

How the Bitspark Remittance Ecosystem Works

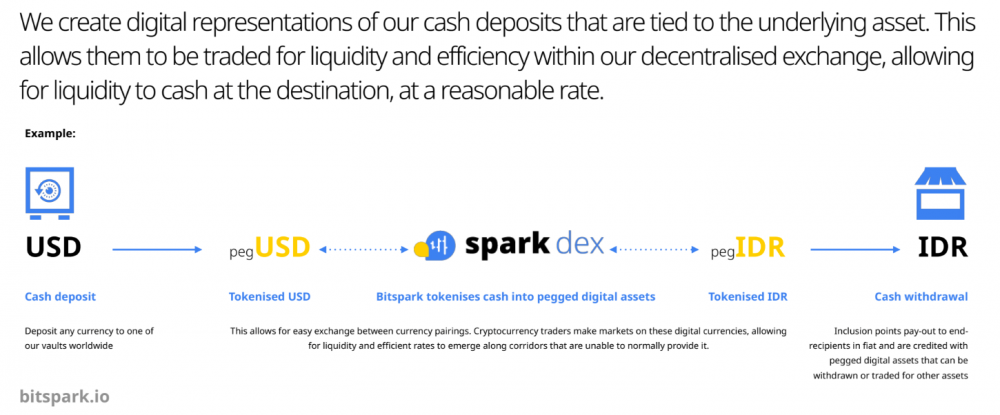

Now they have added DEX functionality which allows traders, investors and other users to add liquidity and capture market opportunities. All while helping provide fuel to the underlying ecosystem Bitspark provides.

Learn more as we dive in with George Harrap on this episode of LAB Radio.

After listening to this episode you will learn:

- George’s background and how he ended up in Hong Kong as an Aussie

- The regulatory landscape and differences between places like Singapore and Hong Kong’s rules and approach to Crypto businesses

- Why and how they chose their current Headquarters location

- How George got status in Hong Kong as an Australian citizen

- The original intent of Bitspark and why they are Crypto Agnostic

- The nature of the cash remittance business and the problems and opportunity George saw to be solved

- How as little as 5-20% of people have bank accounts in many developing nations

- How the cash in, cash out shop process works and the value proposition they provide

- Why George didn’t want to change human behavior but rather improve the process of what people were already doing

- How Bitspark benefits users, shop owners and traders behind the scenes

- An arbitrage opportunity for traders to help create liquidity for shop owners and cash remittance customers

- About Bitshares being the first stable coin that has been working since 2014

- How MakerDAO is a fork of Bitshares built on Ethereum

- Why the promise of not having to trust a companies reserves for a stable coin is a big deal (Hint: Crypto-based parallel FX market)

- How Bitshares experienced a black swan event and what Global Settlement is (and how to avoid that in the future)

- The process for Bitshares to incentivize traders to create Foreign Currency derivatives on their platform to help add liquidity to their

- How market making works through a can of coke analogy

Here is the interview:

Further Reading and Resources

George Harrap | Twitter | LinkedIn | Medium |

Bitspark |

Around The Coin Episode 104 with George